The increase in revenue quarter-on-quarter was a function of a 25% improvement in average realized gold prices, partly offset by an 8% decrease in sales volumes in Q4 2020. Sold 60,655 ounces of gold in Q4 2020 at an average realized gold price of $1,828/oz for record total gold sales proceeds of $110.9 million, an increase of $14.0 million from Q4 2019. Produced 65,571 and 249,904 ounces of gold in Q4 2020 and FY 2020, respectively, exceeding the upper-end of 2020 production guidance of 225,000-245,000 ounces. The AGM's LTI and TRI frequency rates for the three months ended Decemwere 0.37 and 1.10 per million employee hours worked, respectively. There was one Lost Time Injury ("LTI") and three Total Recordable Injuries ("TRI") reported during the quarter. At the corporate level, we delivered record earnings in 2020 and have strengthened our balance sheet with corporate treasury growing to in excess of $62m."Ĭash provided by operating activities ($m) "The AGM exceeded annual production guidance for a second consecutive year, generated record operating cash flows, and executed on a number of exploration programs with promising results at Nkran, Akwasiso and Miradani North. "2020 was a strong operational year at the Asanko Gold Mine, despite the challenges presented by COVID-19, " said Greg McCunn, Chief Executive Officer. Refreshed Board and Vancouver based management team: During the year, appointed Paul Wright as Chair of the Board of Directors, formed a new Sustainability sub-committee of the Board under the leadership of Chair of the Sustainability Committee Judith Mosely and augmented the Vancouver-based management team with the appointment of a Chief Operating Officer and various other senior management positions. Stable balance sheet: Cash on hand of $62.2 million and $2.9 million in receivables at December 31, 2020, while remaining debt free. Record earnings: Generated net income after tax for the year of $57.4 million or $0.26 per share. Return of capital: Returned $75.0m to joint venture participants through cash distributions in 2020.Ĭonsistent cost performance: For the year ended December 31, 2020, total cash costs per ounce 1 of $889 and all-in sustaining costs 1 ("AISC") of $1,115/oz, below revised guidance (as of Q3 2020) of $1,150/oz.

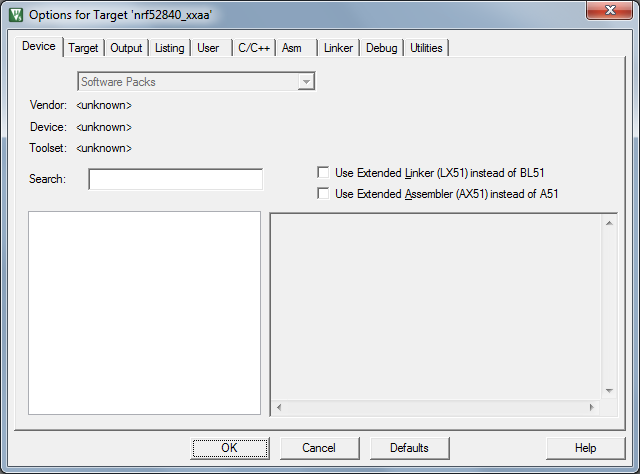

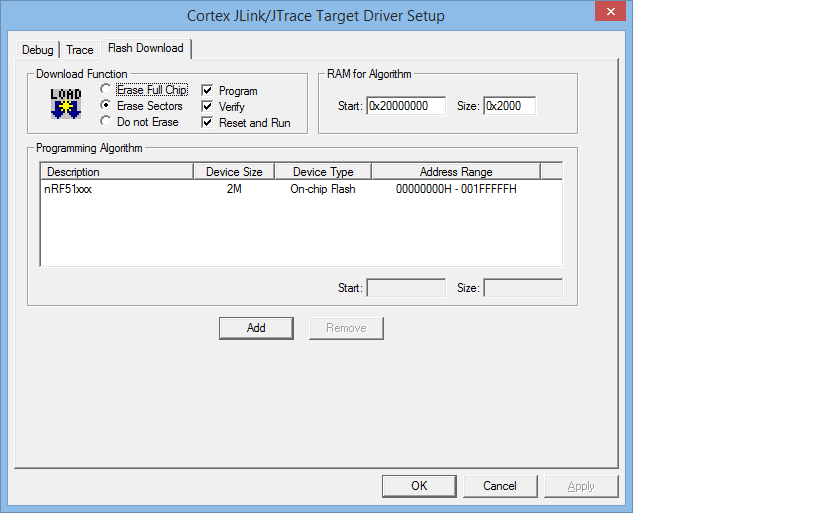

#Nordic keil 5 not showinf 51822 board in targets free

Strong cash generation: Generated $152.3 million of cash flows from operating activities (after taking into account unfavourable working capital changes of $30.7 million) and free cash flow 1 of $66.9 million during 2020. Highlights of the Asanko Gold Mine (on a 100% basis)Įxceeded annual production guidance: Annual gold production of 249,904 ounces, exceeding the upper end of 2020 production guidance of 225,000-245,000 ounces, with 65,571 ounces produced in the fourth quarter. The AGM is a 50:50 joint venture ("JV") with Gold Fields Ltd (JSE, NYSE: GFI), which is managed and operated by Galiano.

("Galiano" or the "Company") (TSX: GAU) (NYSE American: GAU) reports fourth quarter ("Q4") 2020 operating and financial results for Company and for the Asanko Gold Mine ("AGM"), located in Ghana, West Africa.

VANCOUVER, BC, Ma/CNW/ - Galiano Gold Inc. (All dollar amounts are United States dollars unless otherwise stated)

0 kommentar(er)

0 kommentar(er)